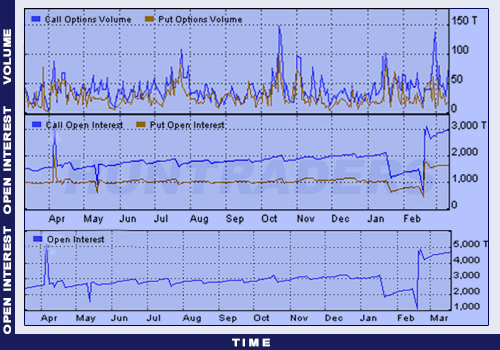

Volume means the contracts traded on a single day. Open Interest is the number of open positions related to a given option. An option position is open, if it has been bought and hasn’t been sold or the option right hasn’t been executed. The two are not necessarily the same data, although it might be confusing first. If the Volume is low, the Open Interest can be still high. The higher the value of the Open Interest, the bigger the chance to close the position and the higher the option’s liquidity. Another way to measure liquidity is to observe the value of the Bid/Ask spread. Bid is the price for which traders can sell an option, Ask is the price for which traders can buy an option. If the difference is high between the two then it has a negative effect on the profitability.

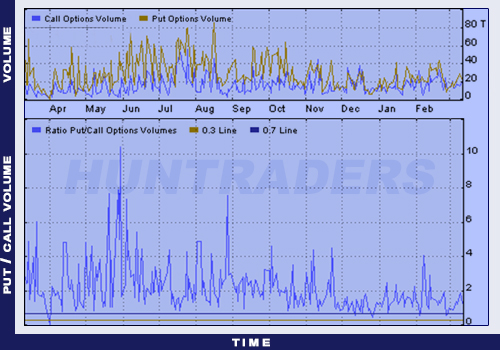

As an example, the Open Interest and Option Volume indicators of MSFT are shown for both Put and Call options. It is clear that the activity of Call options exceeds the activity of Put options. It means that investors expect the prices to increase.

The next chart shows DJX index. The increasing Put/Call ratio indicates a growing bearish market mood, when the investors buy Put options to hedge.