Description and use

Short Straddle is the opposite of Long Straddle strategy. Short-term (one month or less) ATM Put and Call options are sold to enhance the profitability of the portfolio. This is duration is highly recommended, because of the potential unlimited risk. Both components have unlimited risk. When shares are fluctuating in both directions, the position is highly uncertain. The investor can profit from share prices moving within given limits. The direction of the market is neutral. The trader speculates on sideway market moves. The volatility is expected to decrease in the future. However, higher implied volatility is ideal. The duration of the strategy should be one month or less.

- Type: Neutral

- Transaction type: Credit

- Maximum profit: Limited

- Maximum loss: Unlimited

- Strategy: Neutral strategy

Opening the position

- Sell (ATM) Put options (expiration is one month or less).

- Sell (ATM) Call options (same quantity, strike price and expiration as the Put options’).

Steps

Entry:

- Make sure the share prices are moving within certain limits.

- The trading should take place in a period when no news (related to the underlying shares) is expected.

Exit:

- Buy back the options when it is making profit.

Basic characteristics

Maximum loss: Unlimited.

Maximum profit: Received net credit.

Time decay: Time decay has a positive effect on the value.

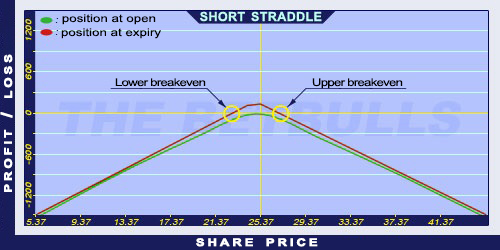

Lower breakeven point: Strike price - Net Credit.

Upper breakeven point: Strike price + Net Credit.

Advantages and disadvantages

Advantages:

- The investor can profit from share prices moving within given limits.

- The strategy has a relatively high expected return.

Disadvantages:

- Too risky below and above the breakeven points.

- Limited profit.

- Highly risky strategy, not recommended to beginners.

Closing the position

Closing the position:

- Buy back the Call and Put options.

Mitigation of losses:

- Buy back the sold options.

Example

ABCD is traded for $25.37 on 17.05.2017. The investor sells a Short Put option which has a strike price of $25.00, expires in June 2017. and costs $1.20 (premium). Then he sells a Short Call option which has a strike price of $25.00, expires in June 2017. and costs $1.50 (premium).

Price Price of the underlying (share price): S= $25.37

Premium (Short Put): P= $1.20

Premium (Short Call): C= $1.50

Strike price (Short Put): KP= $25.00

Strike price (Short Call): KC= $25.00

Net credit: NCr

Maximum loss: R

Maximum profit: Pr

Lower breakeven point: LBEP

Upper breakeven point: UBEP

Net credit: NCr = P + C

Maximum loss (risk): Unlimited

Maximum profit: Pr = NCr

Lower breakeven point: LBEP = K - NCr, where K = KP = KC

Upper breakeven point: UBEP = K + NCr

NCr = $2.70

R = unlimited

Pr = $2.70

LBEP = $22.30

UBEP = $27.70