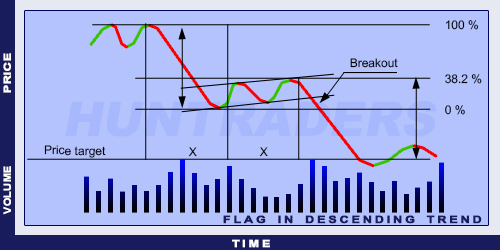

Trend

There must be a trend on the market to talk about a trend continuation pattern. Flag patterns usually have sudden price fluctuations or trading volume decrease. After the flag’s ribbon is formed, the share price moves in a parallel channel.

- Role: Continuation

- Expected trend: Bearish

- Previous tren: Bearish

- Reliability: Moderate

- Pattern: Flag

Flagpole

Flagpole is from the beginning of the trend until the flag’s minimum. The trading volume is especially high at the formation of the flagpole. The flag and the flagpole must take the same amount of time to develop.

Flag

Flag is a short, rectangle-shaped formation, in which the share price moves in a channel. The channel’s direction is the opposite of the trend’s direction. If the trend was descending, the channel will be increasing (and vice versa). Flags usually don’t last long. The trading volume is low during the pattern. The correction cannot exceed 38.2% of the flagpole.

Duration

Flags are usually formed in 1-12 weeks. Some analysts believe 8 weeks are also enough for a flag to develop. Ideally, they develop in 1 to 4 weeks. If the pattern exceeds 12 weeks, it becomes a rectangle pattern.

Breakout

In an ascending trend, the support line must be broken to signal the previous trend’s continuation.

Volume

The flagpole develops when the trading volume is large. The large trading volume comes with a share price increase. The volume increases after the breakout and during the trend’s continuation.

Target price

Target price is determined as the flagpole’s height set on the support and resistance lines. In case of an inclining trend, the flagpole’s height should be set on the line drawn at the top of the correction level.