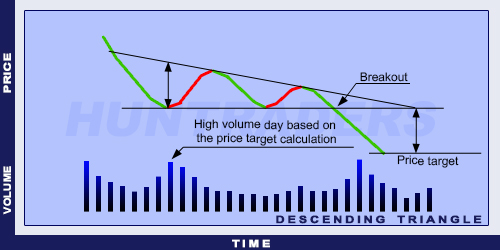

Trend

There must be a trend on the market to talk about a trend continuation pattern. The length and duration of the trend is not important, because the triangle is an inclining pattern. The shape is the only important factor in this case. The share price enters the pattern from above.

- Role: Continuation

- Expected trend: Bearish

- Previous tren: Bearish

- Reliability: High

- Pattern: Triangle

Bottom horizontal line

There must be two minimum values to form the bottom line. These minimum points are not necessarily in line, but they must move within a given range. A certain distance must be between the maximum and minimum values.

Top trendline

There must be at least two maximum values to form the top trendline. These maximums are decreasing over time and they have a given distance between them. If the next wave’s maximum points are in the same height or above the previous ones, the pattern cannot be an descending triangle.

Duration

The duration can last from a few weeks to a few months.

Volume

The trading volume decreases as the pattern develops. There can be a bottom breakout only if there is a high volume. The volume increases at the minimum points and decreases at the maximum points. A volume-based confirmation is not necessary, but highly recommended.

Pullback to the breakout

According to the technical analysis principles, the support line changes into resistance line and resistance line changes into support line. When the price breaks the bottom horizontal line of the triangle, it will act like a resistance. Sometimes the share price returns to this line before it starts decreasing.

Target price

The basis of the target price calculation is the group of days with large trading volume at the beginning of the pattern.